Some confidence is sprouting because the big institutions act courageously, and medicine achieves top performance

These days, our thoughts and conversations almost exclusively revolve around the immediate impact of the corona pandemic on our personal lives, on society and on our future after the crisis. The human tragedy of the pandemic is bitterly brought home to us by the various platforms and the daily stream of news on all conceivable channels.

These days, our thoughts and conversations almost exclusively revolve around the immediate impact of the corona pandemic on our personal lives, on society and on our future after the crisis. The human tragedy of the pandemic is bitterly brought home to us by the various platforms and the daily stream of news on all conceivable channels. The economic consequences are immediately felt due to the serious measures that have been taken in many countries to achieve effective social distancing. And it doesn't take much imagination to conceive the medium and long-term effects on the economy and thus our livelihoods. It is already foreseeable that the economic damage will be immense. Nevertheless, the current measures are indispensable. The first priority now is to save human lives. We must work together to slow down the spread of the Covid-19 virus. Only then will our health systems have the chance to help all people critically infected by the virus, to prepare for larger numbers of patients and to develop therapies to mitigate the course of the disease. The consistent shutdown of public life is the indispensable first step in overcoming the most serious crisis since the Second World War.

On the one hand, it is now necessary to protect human life directly. On the other hand, we must not lose sight of the fact that maintaining economic activity is also an indispensable basis for the sustainable health of people and peaceful coexistence in our society. Under the current, necessary restrictions, substantial parts of the economy have come to a standstill. Some sectors are particularly hard hit, e.g. the travel industry: when no one is allowed to travel, airplanes remain on the ground and hotels are closed. Trade fairs and congresses are being cancelled in series. Higher-value consumer goods are not bought and investment decisions in companies are postponed. People fear unemployment and look to the future with great concern. Many companies, especially medium-sized companies, will certainly not survive the crisis on their own. Never before has there been so much uncertainty about future economic development.

The capital markets have had five extremely turbulent weeks. With extraordinarily high volatilities, massive price slumps in risk-bearing investments were observed around the globe. In particular, equities and corporate bonds were valued at significantly higher risk premiums, which led to sharp price falls in the corresponding markets. The classic "safe havens" such as US Treasuries or gold showed considerable malfunctions at times. Rising liquidity preferences of market participants led to panic selling of investments of all kinds. Never before capital market players had to price in the effects of an international shutdown of the economy for weeks or even months.

In order to prevent an immediate collapse of the system, national governments and central banks have initiated rescue measures on an unprecedented scale over the past four weeks. Huge financial aid packages are being made available to rescue the companies affected by the shutdown. In return, the states are prepared to incur new debts on a large scale. All this is going through parliaments at record speed. The central banks are also setting their mark, flooding the markets with almost unlimited liquidity, mainly through their new bond purchase programs. In comparison, the quantitative easing during the last financial crisis looks more like a mere exercise in easing. The economy and capital markets have been in intensive care for a few weeks now.

Certainly, it is also the courageous actions of the institutions that have brightened the mood on the capital markets somewhat in recent trading days. The global stock market index MSCI World is still almost 20 percent below its value at the beginning of the year and the CBOE index for volatility of the S&P 500 (VIX) is drifting around 60 percent. However, the strong selling pressure on the equity markets with successive, very negative daily returns - the downward spiral of share prices worldwide - seems to have been broken somewhat. Obviously, the risk appetite of market participants is rising again these days, and a small "seed of confidence" is sprouting from the ground.

The mood on the capital market is currently and until further notice dependent on news from three areas. These are three challenges that must be managed by the global community in a very short-term, very determined and very successful manner. Developments in these areas are nourishing the confidence that is growing in these days. Sustainable successes will certainly have a positive impact on investors' risk appetite:

- Management of the infection dynamics: If it becomes clearer that the global community is capable of containing the immediate rapid spread of the virus in order to maintain and strengthen the functioning of health systems, as described above, investor confidence will increase. Although the number of cases of corona infections is still rising rapidly worldwide, the momentum seems to be slowing down somewhat. Mathematically speaking the second derivative of the infection growth curve seems to tend towards the negative value range. The massive restriction of contacts between people, the social distancing enforced in almost all countries proves the determined and consistent action of governments to avoid an even greater human tragedy. The development of prices on the stock markets and also of corporate bonds over the last few days indicates that market participants are beginning to build up a certain amount of confidence in these measures. Further good news about the effect of the measures, accompanied by a clearly visible flattening of the curve, as well as progress in the medical management of the crisis, is expected to further stabilize the capital markets.

- Management of corporate solvency: The far-reaching standstill of the economy leads many companies, especially small and medium-sized enterprises, into insolvency in the short term. Governments have understood that they must support companies and freelancers with liquidity, credit guarantees, loans and simplified access to state services. They are doing this, and they are doing it boldly. The United States provides two trillion US dollars in aid. The German federal government's rescue package of around 750 billion euro is the largest in the world relative to the country's gross national product. Similar packages are being put together in all countries. The crucial thing now is that this money for maintaining the economy and future purchasing power reaches where it is urgently needed very quickly and without formalities. Good news about the successful implementation of these programs will further stabilize investor confidence.

- Management of market functionality: In recent weeks, market distortions have been observed at times, which have indicated panic-like

behavior by market participants. These were the days when the prices of all securities and precious metals suddenly slipped due to massively increased liquidity preferences or when trading in US Treasuries was disrupted. Only the central banks can manage this issue. They do, and just like governments, they do it courageously. The FED, the ECB and other leading central banks are executing drastic measures on an unprecedented scale, flooding the markets with liquidity on a daily basis. Although it is still largely unclear what this enormous market liquidity and the explosive growth in central banks' balance sheets will do to us in the medium and long term, these measures are essential as a ‘hygiene factor’ in the current situation. If this prevents market disruptions in the near future, it will further stabilize the risk appetite of the players.

The global recession will come, that's for sure. The extent of this recession is difficult to assess at present, because there has never been a global crisis that directly affects everyone in their lives. It is also difficult to estimate how much of it the markets have already priced in. As all information is available, current prices should largely reflect prevailing expectations. As already mentioned, some confidence is just beginning to emerge. This may turn around very quickly if the situation in the three areas changes. The markets will remain highly volatile.

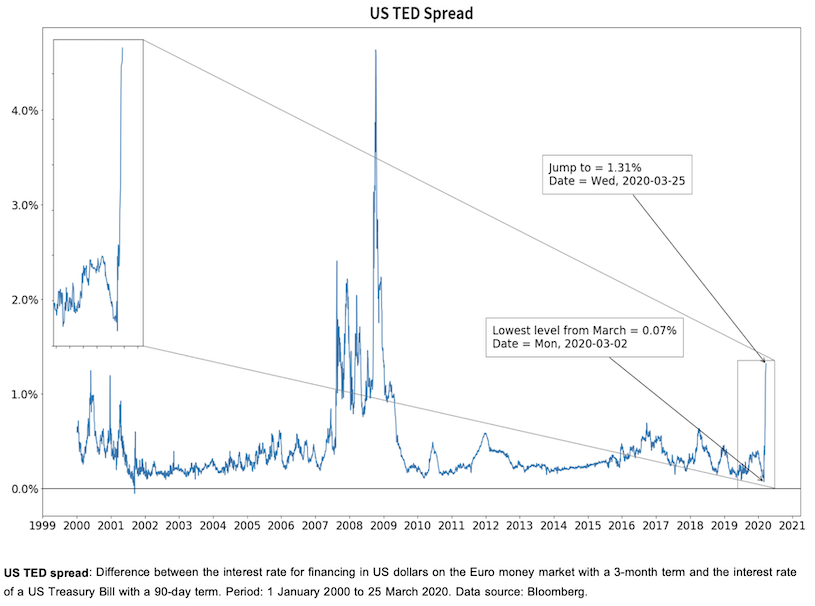

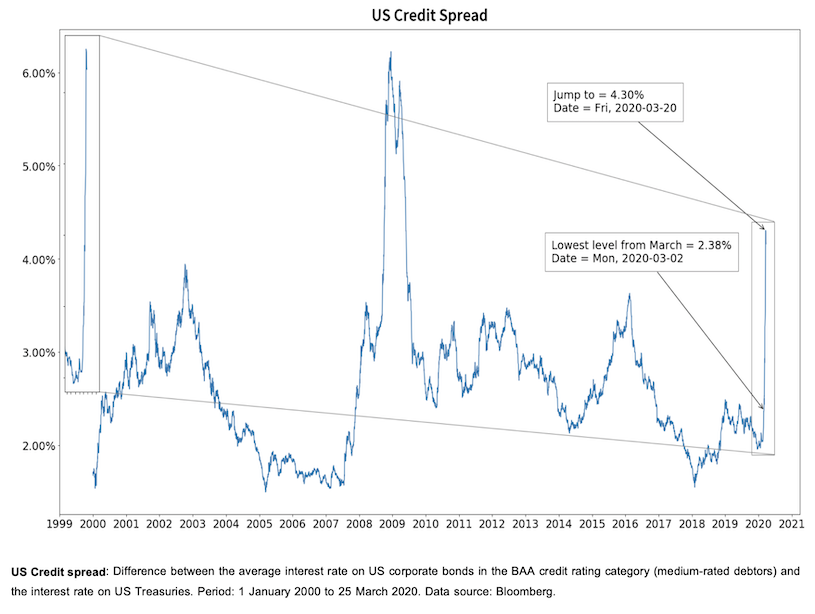

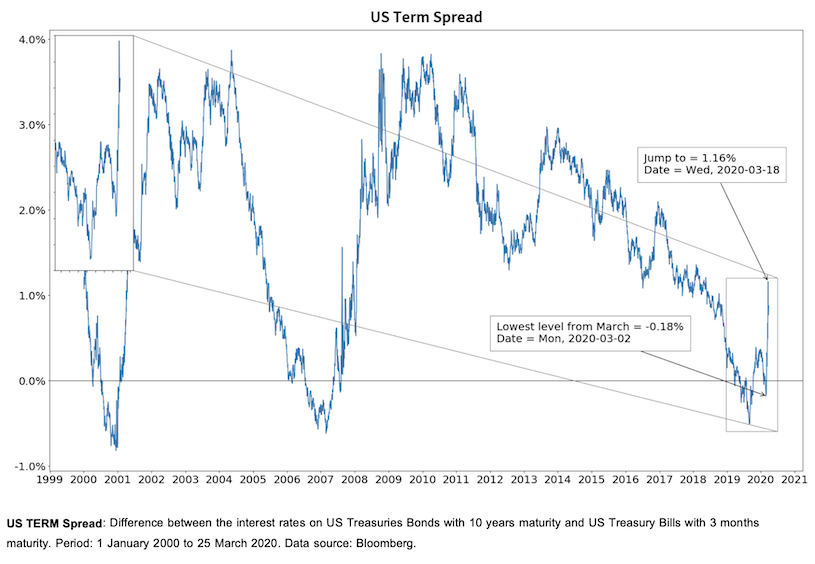

Since the capital markets are known to look very far into the future and the expectations of the aggregate of market participants are traded there, it is worthwhile to analyze selected, scientifically sound information carriers on the capital markets in addition to the daily news flow on the corona crisis. Above all, interest rates and interest rate differentials are important indicators of the expectations and risk appetite of market participants. In the current situation, we are observing three interest rate differentials very closely; these are shown graphically in the appendix. New developments in the above three areas will be directly reflected in them.

- US TED (Treasury-Eurodollar) spread: The difference between the interest rate for US dollar-denominated financing in the euro money market with a 3-month maturity and the interest rate of a US Treasury Bill with a 90-day maturity reflects the prevailing confidence of market participants in the financial system and their general preference for liquidity. Specifically, the TED spread captures the interest rate premium for the counterparty risk of banks operating in the euro money market. Over the past 10 years, this spread has mostly been at levels between 0.1 and 0.5 percent due to the highly expansive policies of central banks. However, since the beginning of March we have seen a rapid widening of the spread from 0.07 percent to 1.31 percent today. Market participants' confidence in banks and the financial system in general has thus deteriorated sharply and massively since the outbreak of the corona pandemic. The further course of the TED spread will provide us with information on the stability of the financial system, and will show us whether the measures taken by central banks are actually sufficient.

- US credit spread: The difference between the interest rate on US corporate bonds in the BAA credit rating category (medium-rated borrowers) and the interest rate on US Treasuries, which have the highest credit rating, reflects market participants' confidence in the financial strength of companies. In the course of March, this spread has risen from 2.38 percent to 4.16 percent today. Investors are much more critical of the solvency of companies than they were a few weeks ago. The further development of the credit spread will provide us with information on the state of health of companies and will show whether the fiscal rescue packages of the states are finding traction in their implementation.

- US TERM spread: The shape of the yield curve reflects the traded expectations of market participants regarding economic development. A steep yield curve indicates positive economic expectations, while a flattening of the curve is often accompanied by recessionary tendencies or a recession. The US TERM spread (10Y-3M), i.e. the difference between the interest rates on US Treasuries with a 10-year maturity and those with a 3-month maturity, has tended to fall sharply over the past 5 years, and was negative on several occasions in 2019. It was also negative in February of this year when the corona pandemic became apparent. The systematically shrinking and at times negative US TERM spread is a reliable indicator that certain expectations of a recession have been in play in the USA for some time. The two interest rate cuts by the Federal Reserve on March 3rd by 0.5 percent in the range from 1.00 to 1.25 percent and on March 15th by a further 1.0 percent in the range from 0.00 to 0.25 percent have turned the yield curve somewhat around and made the US TERM spread slightly positive; the current value is 0.87 percent. In the end, the FED's massive measures have stunned the bond markets for the time being. The further course of the US TERM spread will show us the economic trends in the most important national economy.

These indicators, in addition to other macroeconomic variables and fundamental criteria, are also incorporated into our ML algorithms and are partly responsible, in particular, for the equity exposure in the portfolios. In the coming weeks we will come back to these three interest rate differentials again and try to classify the developments.

It is now the time of the big institutions and of all those who perform at the highest level in medical care and research every day. But we ourselves can also do something! We can help other people and contribute to securing our economic livelihoods if we now stay at home in a disciplined manner and act in solidarity. We must not lose our optimism!

Autor

Dr. Peter Oertmann | Chairman of the board

oertmann@ultramarin.ai

Appendix