Daily business under uncertainties

Uncertainties are part of the day-to-day business on the capital markets. At the moment there are quite a lot of them: The Corona pandemic is triggering new waves of infection around the globe, restricting people's lives worldwide and destroying several business models - the medium-term economic consequences will be serious, but are difficult to assess at present.

Uncertainties are part of the day-to-day business on the capital markets. At the moment there are quite a lot of them: The Corona pandemic is triggering new waves of infection around the globe, restricting people's lives worldwide and destroying several business models - the medium-term economic consequences will be serious, but are difficult to assess at present. The highly divided society in America is about to elect a president - two men of advanced age are competing against each other, although the current state of health of one is somewhat unclear. The United Kingdom will stumble out of the EU, leaving deep economic traces and weakening Europe as a whole. The trade conflict between the two largest economies, the USA and China, is far from being resolved. In addition, there are several regional crises with supra-regional political implications and potentially destabilizing effects for the global economy. Overall, the world seems to be slightly out of joint at present.

The stock markets are aware of all these uncertainties and have processed their consequences in pricing largely efficiently. As the MSCI World stock index has now risen by just under 4% since the beginning of the year, it is clear that there has been a surplus demand for shares in the current year despite the many crises and threatening uncertainties. After the considerable market distortions in spring due to the global lockdowns, the risk appetite of market participants has very quickly receded again. As is well known, this is based on the courageous action of central banks and governments in the fight against the pandemic and its economic consequences. Above all, the massive injection of liquidity into the markets and the explicit prospect of extremely low interest rates in the long-term have stabilized the valuations of shares and other risk-bearing investments. We have examined this complex of issues in detail in our previous Market Insights.

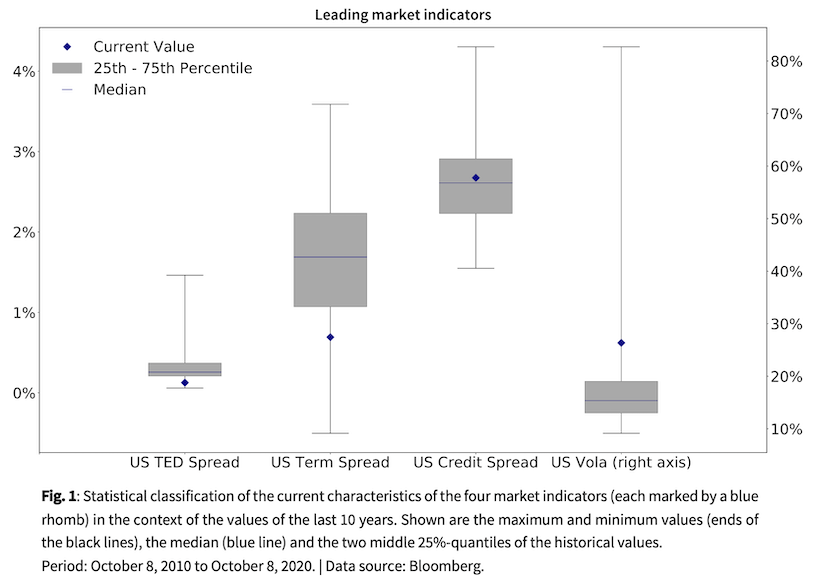

The sideways movement of prices on the stock markets observed in recent weeks corresponds to a largely stable risk environment. We take a brief look at four of our quantitative market indicators. Figure 1 in the appendix provides a statistical classification of these indicators in the historical context of the last 10 years.

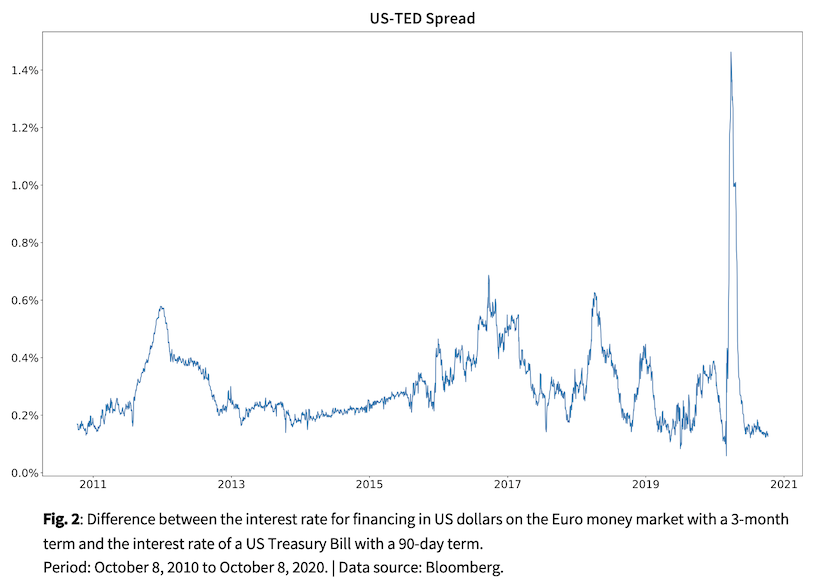

The US TED Spread (Fig. 2), the difference between the interest rate for US Dollar financing in the Euro money market and the interest rate of a US Treasury Bill, each with a term of 3 months, corresponds to the prevailing confidence of market participants in the financial system and the general liquidity preference. The deep uncertainty in the markets in the course of March, accompanied by sudden concerns about the stability of the financial system, caused the TED spread to jump from a value close to zero to around 1.4%. Currently (October 8), the US TED spread of 0.13% is in the lowest 25%-quantile of its historical value range and points to a stable liquidity environment.

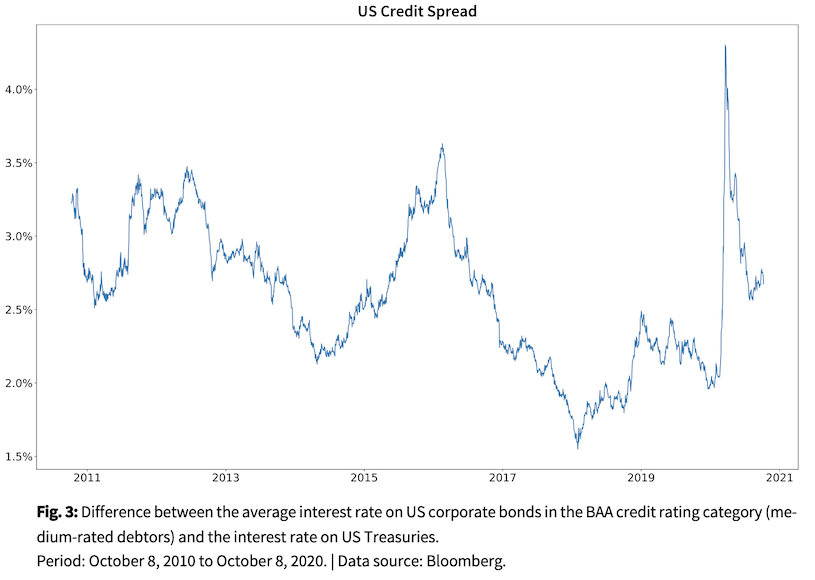

The US credit spread (Fig. 3), measured by the difference between the interest rate on American corporate bonds in the BAA credit rating class and the interest rate on US Treasuries, reflects the assessment of the health of companies in the market. This spread reached a value of 4.30% on 20 March as a result of the pandemic shock. Since then, it has tended to narrow again, and currently (on October 8) stands at 2.67%. The risk premium is currently just above the median in the third 25%-quantile of its historical values. Market participants are pricing in increased credit risks, but not at a crisis level.

The US TERM Spread (Fig. 4), the difference between the interest rates on US Treasuries with a 10-year maturity and those with a 3-month maturity, is a proxy for the economic expectations traded in the market. This spread continues to move sideways at a level of 0.69% (on October 8), the lowest 25%-quantile of its historical values. The persistently flat yield curve in the United States documents the considerable economic risks in the world's largest economy; according to a statement by the Business Cycle Dating Committee of the National Bureau of Economic Research (NBER), the US economy has officially been in recession since March 2020.

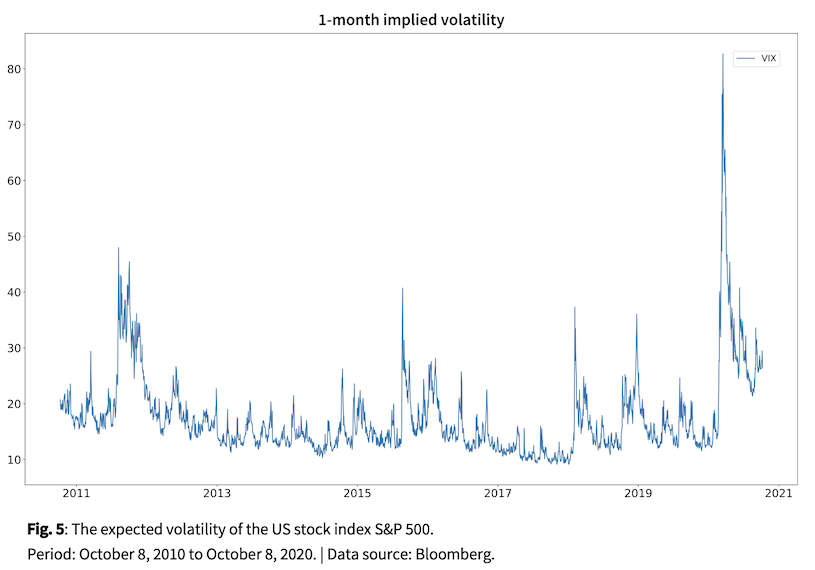

The VIX Index (Fig. 5) measures the expected volatility of the American stock index S&P 500, which is calculated by the Chicago Board Options Exchange (CBOE) as implied volatility from options transactions. Until February 21, the VIX was valued at between 15% and 20%, then shot up to 80% during March, indicating a market uncertainty of historic proportions. However, the massive uncertainty slowly subsided again over the months of May, June and July. Currently (on October 9), the VIX is back at 26.36%, but still in the top 25% quantile of its historical value range. Although market uncertainty is no longer as extreme as it was when the pandemic broke out, it is still significantly higher.

Conclusion

Overall, the capital market is showing a risk environment with increased economic uncertainties, which continues to be stabilized and supported by liquidity on an unprecedented scale and fiscal measures. The robustness of the stock markets in this year of crisis is largely based on the very strong performance of growth stocks, especially technology stocks. The difference in returns between the growth and value segments in the MSCI World share index is more than 30% in the current year, which indicates a clear preference of investors for high-growth business models. This focus reflects the expectations of market participants regarding entrepreneurial opportunities in the highly discussed 'New Reality' according to Covid-19. Although the valuations of technology stocks were corrected by about 10% in the course of September, they remain to be the dominant source of returns in the current year.

Although the many uncertainties, as mentioned above, are priced in, there is a considerable potential for setbacks on the stock markets. The information available on major issues such as the Corona pandemic, the US election or Brexit can change risk appetite very suddenly. Without question, equities are the dominant investment alternative in the long-term simply because of the high dividend yields compared to long-term government bond yields. In the current situation, however, fluctuations are to be expected in the short term. Our machine-supported learning algorithms process fundamental company data, macroeconomic data and price histories in a holistic valuation model. The current equity exposure of our fund with a focus on Europe is slightly above the neutral allocation. However, the fund overweighs defensive sectors such as healthcare, consumer staples and utilities.

Author

Dr. Peter Oertmann | Chairman of the board

oertmann@ultramarin.ai

Data Analysis

David Dümig | Senior Quantitative Investment Researcher

duemig@ultramarin.ai

Appendix