Capital markets are beginning to trade the "new normality" and can obviously gain something from it

The capital markets generally look very far into the future without emotions. Otherwise - in view of the daily abundance of news about the human tragedy of the corona pandemic and the consistently very negative forecasts for the global economy - the relative stability on the stock markets or even the positive development of prices over the past two weeks could not be explained.

The capital markets generally look very far into the future without emotions. Otherwise - in view of the daily abundance of news about the human tragedy of the corona pandemic and the consistently very negative forecasts for the global economy - the relative stability on the stock markets or even the positive development of prices over the past two weeks could not be explained.

In our Market Insight of March 30, we had worked out that, for the time being, risk appetite on the capital market and thus demand for risky investments will be mainly influenced by the extent to which the global community and the relevant institutions are able, firstly, to manage the dynamics of the corona infection curve, secondly, the solvency of companies in this phase of widespread economic shutdown, and thirdly, the functionality of the markets.

Currently, market participants are obviously assuming that the spread of the corona virus can be brought under sufficient control by the consistent measures taken by governments, that the enormous rescue packages of the states will adequately mitigate the immediate consequences of the shutdown and that the central banks will keep the risk transfer on the markets functional with their purchase programs and credit facilities. The global market index MSCI World has already risen by more than 20 percent since its low at the summit of uncertainty about the course of the pandemic on March 23. The American stock index S&P 500 has even gained more than 25 percent in the same period. However, volatility on the equity markets is still very high, with the CBOE index for volatility of the S&P 500 (VIX) still at 40 percent, which is about twice as high as in normal times. In particular, the first-quarter company reports will continue to cause high volatility in the coming weeks, but the capital markets seem to have weathered the first shock wave of the corona pandemic.

Progress in the three fields mentioned above - infection dynamics, corporate solvency, market functionality - is reassessed daily on the capital market, especially with regard to the possible medium and long-term economic consequences. Leading institutes expect a drastic slump in global economic activity. The IMF is expecting the deepest recession since the Great Depression in the 1930s - in concrete terms, the global economic growth forecast has been lowered from the original plus 3.3 percent to minus 3 percent. There has never been such a significant revision of expectations. Nor has such a sharp decline in the global economy ever been expected before. The evolution of economic data these days clearly shows the way into this recession. In recent weeks alone, more than 22 million people have lost their jobs in the US.

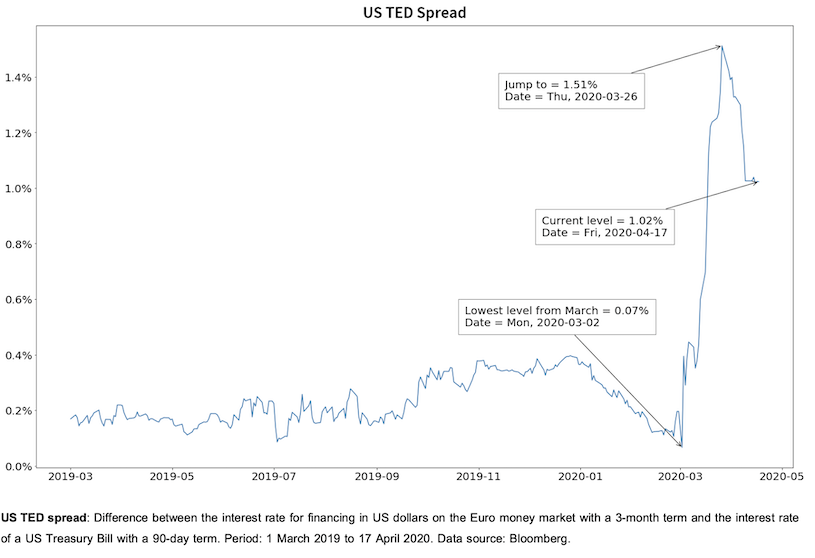

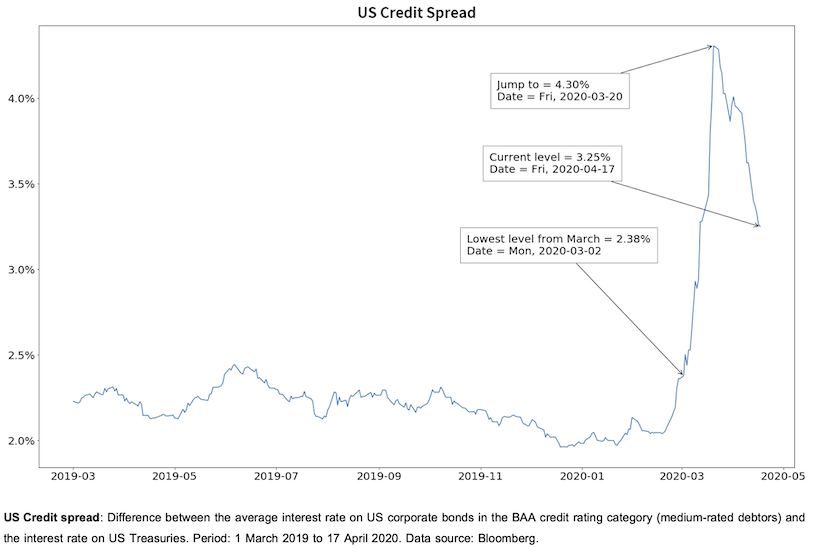

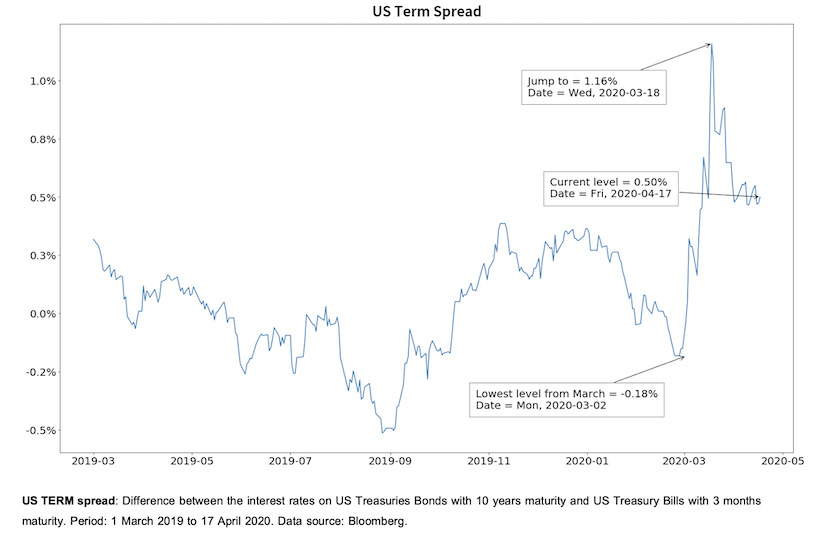

Investors are well aware of these figures and projections. Nevertheless, the dramatic developments in economic data and the gloomy forecasts do not appear to overly impress the risk appetite on the capital market at present. Some technical market analysts classify current market dynamics as a "bear market rally" expressing their assumption that we see an interim recovery of prices in a sustained bear market. However, technical market classifications have no usable economic substance. We assume that the prices on the capital market reflect investors' expectations and that the positive market development of recent weeks is indeed linked to a well-founded assessment of the medium to long-term effects of the corona pandemic. There is strong evidence that the situation is calming down, especially in the interest rate markets. As in the last Market Insight, we analyze the US TED Spread, the US Credit Spread and the US TERM Spread as traded indicators of market participants' risk appetite.

The US TED (Treasury-Eurodollar) spread, the difference between the interest rate for US dollar financing in the Euro money market with a 3-months term and the interest rate of a US Treasury Bill with a 90-day term, serves as a proxy for the prevailing confidence of market participants in the financial system and their general liquidity preference. The deep market uncertainty in the course of March caused the TED spread to jump from 0.07 to around 1.51 percent. This level was last reached in the financial market crisis of 2008. The immediate and comprehensive measures taken by the major central banks to provide almost unlimited liquidity were able to calm the situation, as the TED spread has since returned significantly to a value of 1.02 percent (on April 17).

The US credit spread also points to the development of new confidence in the financial strength of companies after the pandemic shock. The difference between the interest rate on US corporate bonds in the BAA credit rating class (medium-quality debtors) and the interest rate on US Treasuries, which have the highest rating, rose from 2.4 to 4.3 percent in the course of March. This is because the corona virus has also directly caused serious doubts about the health of companies. However, this spread has also narrowed again in recent weeks to a value of 3.25 per cent (on April 17), which indicates that investors are evidently having confidence in the scale and effect of the rescue packages.

Finally, we look at the US TERM spread, specifically the difference between the interest rates on US Treasuries with 10 years to maturity and those with 3 months to maturity. A widening spread between these rates due to a rising yield curve indicates positive economic expectations, while a narrowing spread due to a flattening of the curve is associated with recessionary trends or a recession. In February, the corona pandemic hit an already very flat US yield curve, i.e. certain expectations of recession had been in play in the US for some time. The two interest rate cuts by the US FED in March and the other measures have turned the yield curve around somewhat and caused the TERM spread to climb to a value of 1.16 percent. However, the effect of the actions has since weakened somewhat, with the spread currently standing at 0.50 percent (on April 17). In other words, the recessive tendencies cannot be eliminated even with the FED's heaviest guns.

Conclusion

The daily news is rather unpleasant. Above all, the short-term economic expectations are gloomy. However, both the observation of asset prices in recent weeks and the analysis of interest rate structures show that investor confidence in the market is slowly coming back. Market participants believe in the effect of the extensive measures taken by governments and institutions and assume that after a severe recession, strong catch-up effects will immediately boost the economy again. The IMF is already forecasting global economic growth of almost 6 percent for 2021. We will then probably be in a world with changed conditions and preferences. The capital markets are already dealing with this "new normality" and can apparently gain something from it.

Author

Dr. Peter Oertmann | Chairman of the board

oertmann@ultramarin.ai